Bitunix has positioned itself as a promising cryptocurrency derivatives exchange, attracting users with its sleek interface and the allure of leveraged trading. However, beneath this polished exterior lies a growing wave of troubling reports and unresolved issues that investors and traders cannot afford to ignore.

One of the most alarming aspects of Bitunix is its regulatory status—or rather, the lack thereof. While the platform claims to operate under Seychelles jurisdiction, the Seychelles Financial Services Authority has made it clear that Bitunix is neither licensed nor regulated by them. This absence of official oversight is far from a trivial detail. It places users in a precarious position, stripping them of essential legal protections and recourse in the event of disputes or platform failures. In an industry where trust and transparency are paramount, this regulatory void casts a long shadow over Bitunix’s legitimacy.

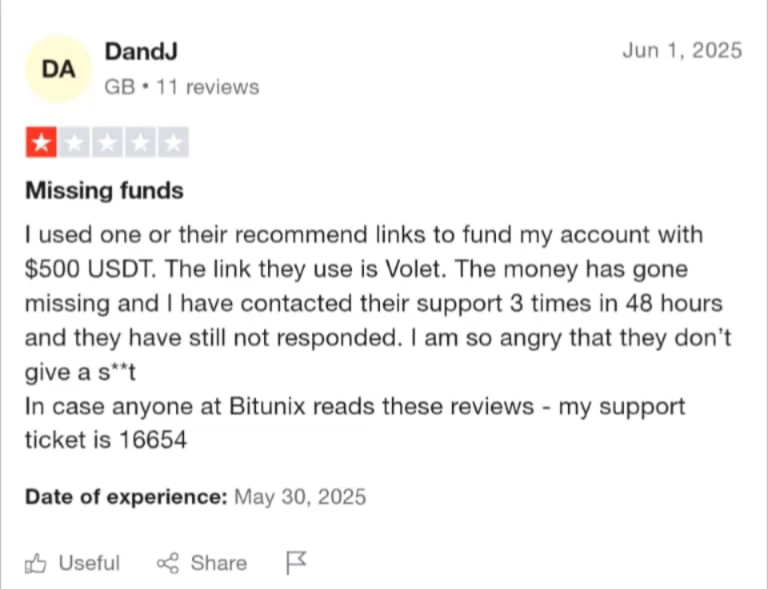

The problems don’t stop at compliance issues. Numerous users have reported severe difficulties when attempting to withdraw their funds. What emerges is a pattern of accounts being frozen or blocked precisely at the moment users try to move their money off the platform. Some are suddenly required to submit extensive identity verification documents only after initiating withdrawal requests, effectively holding their funds hostage. Others have shared experiences of customer support becoming unresponsive or completely disappearing once these issues arise. Such behavior has understandably sown distrust and frustration among the user base.

Beyond withdrawal woes, there are even more concerning allegations related to the platform’s trading mechanics. Traders have voiced suspicions that Bitunix may be manipulating trade outcomes in ways that unfairly disadvantage them. Claims include positions being closed arbitrarily without user consent, stop-loss orders triggered at prices that do not reflect actual market conditions, and unexplained slippage that converts what should be profitable trades into losses. If these allegations hold true, they go beyond mere poor service and edge dangerously close to fraudulent behavior undermining the very foundation of what a trading platform is supposed to offer: fairness and transparency.

Community management practices on Bitunix further exacerbate these concerns. The platform’s presence on social channels such as Telegram and Reddit appears heavily moderated, with many users reporting that critical voices or negative experiences are swiftly deleted or result in bans. This kind of censorship stifles open discussion and prevents potential users from gaining a balanced view of the platform’s risks and benefits. In a healthy trading ecosystem, transparency and community feedback should be encouraged, not suppressed.

Adding to the growing list of red flags, several scam tracking websites and crypto watchdogs have issued warnings about Bitunix or its affiliated domains. These sources highlight patterns commonly seen in fraudulent operations such as fake promotions designed to lure unsuspecting investors, withheld withdrawals until additional payments are made, and opaque business practices that hide critical information from users. These external alerts, combined with firsthand user reports, paint a troubling picture that demands caution.

In an industry rife with both opportunity and risk, Bitunix stands out as a platform fraught with significant hazards. Its lack of regulatory oversight, persistent withdrawal challenges, alleged trade manipulations, and tight control over community dialogue raise serious questions about its integrity. For traders and investors seeking a trustworthy venue for their cryptocurrency activities, these issues serve as a stark warning.

While Bitunix may present itself as an innovative player in the crypto derivatives space, the weight of evidence suggests it is a platform that carries far more risk than many users might anticipate. For anyone considering engaging with Bitunix, prudence and skepticism are essential. Opting instead for exchanges with strong regulatory compliance, transparent operations, and responsive customer support is a far safer path in the unpredictable world of cryptocurrency trading.

To wrap it up, Bitunix’s glowing facade hides a minefield of risks that every trader and investor should take seriously. In crypto, where trust is everything, operating without solid regulation and ignoring user rights is a red flag you can’t afford to overlook. From withdrawal roadblocks to suspected trade manipulations and silenced criticism, the signs point to a platform that prioritizes appearance over accountability.

If you’re aiming to protect your capital and sanity, steer clear of platforms like Bitunix that operate in the shadows. Instead, choose exchanges that are transparent, properly regulated, and genuinely committed to their user community. Because in this game, playing it safe isn’t just smart — it’s essential. Stay sharp, do your homework, and don’t let flashy promises blind you from the facts.