In the volatile world of cryptocurrency, choosing a secure and reliable exchange is paramount. While CoinEx has been operational for several years, a closer look at its history and operational environment reveals several red flags that should give potential users pause before entrusting their digital assets to the platform.

The Haunting Shadow of a Major Hack

Perhaps the most significant black mark against CoinEx is the devastating security breach it suffered in September 2023. Reports indicate that approximately $70 million worth of cryptocurrency was siphoned from the exchange's hot wallets. While CoinEx publicly stated they would cover user losses and implemented new security measures, such an event inevitably erodes user trust. For many, a single major hack is enough to permanently question an exchange's ability to safeguard funds. The crypto space is rife with examples of exchanges that never fully recovered their reputation – or their user base – after a significant breach. Despite CoinEx's efforts to rebuild, the memory of such a substantial security failure will linger for discerning investors.

Regulatory Loopholes and Limited Oversight

Another significant concern for CoinEx users stems from its regulatory landscape. Headquartered in Seychelles, CoinEx operates in a jurisdiction often associated with more relaxed financial regulations compared to major global financial hubs. While the exchange might possess an MSB license in the US, this doesn't equate to the rigorous oversight and consumer protections offered by top-tier financial regulators in jurisdictions like the EU or the UK.

This lack of robust, comprehensive regulation means that users may have limited recourse in the event of disputes, technical failures, or further security incidents. When things go wrong, the absence of a strong regulatory body can leave users feeling exposed and without adequate legal protection. Furthermore, CoinEx's terms of service explicitly state that its services are not available to residents of the USA, Canada, Hong Kong SAR, and the People's Republic of China, highlighting its selective and geographically limited regulatory footprint.

The Inherent Risks of Centralized Custody

Like most centralized exchanges, CoinEx operates on a custodial model – meaning they hold the private keys to your cryptocurrency. This fundamental design choice inherently creates a single point of failure. Despite claims of cold storage and advanced security protocols, the fact remains that your assets are not truly in your control. The September 2023 hack serves as a stark reminder of the inherent risks when a third party controls your private keys. While CoinEx attempts to mitigate these risks with features like 2FA, withdrawal passwords, and anti-phishing codes, the fundamental vulnerability of centralized custody remains. Users who prioritize true ownership and control often opt for non-custodial wallets precisely to avoid these risks.

User Experience and Support: A Mixed Bag

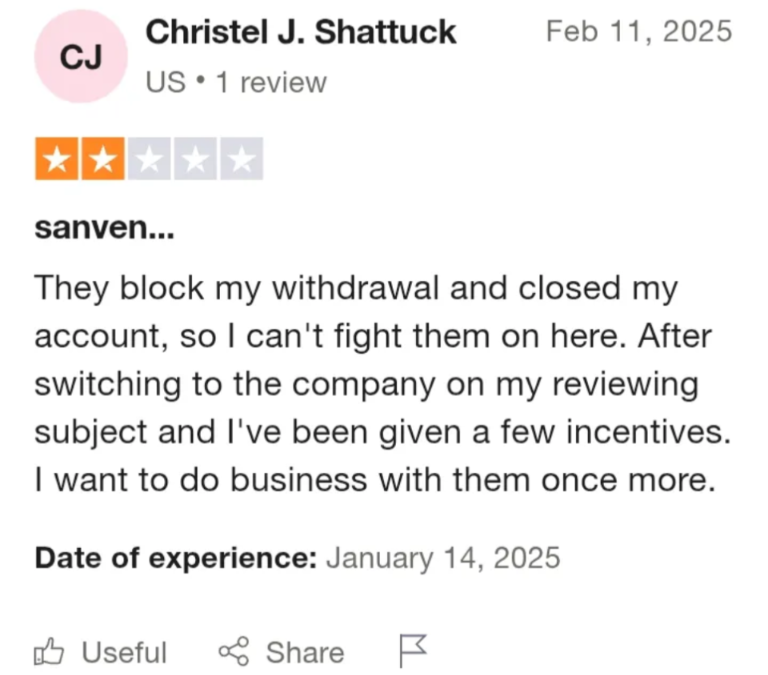

While some users might praise CoinEx for its range of supported cryptocurrencies or specific trading features, a dive into various user forums and review sites reveals a mixed bag of experiences. While CoinEx offers 24/7 customer support via email and a ticketing system, some users have reported inconsistent response times, which can be particularly frustrating when dealing with urgent financial matters. For new users, the interface might present a steeper learning curve than more user-friendly alternatives, potentially leading to errors or frustration. Moreover, as CoinEx itself warns, users must be vigilant against common scam tactics, including fake customer service and unofficial communication channels, implying a broader challenge in ensuring a consistently secure user environment.

The Verdict: Proceed with Extreme Caution

Given the substantial security breach in its recent past, the less-than-stringent regulatory environment, and the inherent risks of centralized custody, CoinEx appears to be a platform that demands extreme caution from potential users. While no exchange is entirely risk-free, the aggregated concerns surrounding CoinEx suggest that safer and more robust alternatives are available for those looking to securely trade and store their valuable cryptocurrency assets. Before depositing your funds, carefully weigh these significant drawbacks against any perceived benefits. Your digital assets deserve a platform with an unblemished security record and comprehensive regulatory backing.

⚠️ Final Verdict: Proceed with Extreme Caution

CoinEx's significant security breach in September 2023, resulting in the loss of approximately $70 million, underscores the inherent risks associated with centralized exchanges. Despite efforts to compensate users and implement new security measures, the compromised private keys and the involvement of North Korea-linked hackers raise serious concerns about the platform's security protocols.

Ex's operational base in Seychelles, a jurisdiction with a reputation for lax financial regulations, coupled with its limited regulatory oversight, adds another layer of risk for users.

Given these factors, potential users should exercise extreme caution. Exploring more secure and regulated alternatives, such as Binance, Kraken, or Coinbase, may offer better protection for your digital assets.