In the high-stakes world of cryptocurrency trading, security isn't just a feature—it's a fundamental necessity. While many leading exchanges offer asset insurance to protect users against hacks, system failures, or unforeseen incidents, LBank falls conspicuously short in this regard.

The Absence of Asset Insurance

LBank does not provide asset insurance for user funds. This means that in the event of a security breach, hack, or platform failure, users bear the full brunt of the loss. Unlike exchanges that offer insurance coverage for hot wallet funds or have self-insurance pools, LBank leaves its users exposed without any external safety net or compensation mechanism.

Understanding LBank's Insurance Fund

While LBank does have an "Insurance Fund," it's crucial to understand its limitations. The fund is designed to cover losses when client accounts go below zero due to liquidation events in futures trading. However, this fund is not intended to protect users' assets from general platform risks or security breaches. It primarily serves to limit occurrences of counterparty liquidation and is not a substitute for comprehensive asset insurance .

Comparison with Industry Standards

Leading exchanges in the cryptocurrency space recognize the importance of user protection and have implemented substantial insurance funds. These measures offer users a psychological and financial buffer, knowing that a portion of their assets might be recoverable in worst-case scenarios. LBank's lack of such protection places the entire burden of risk solely on its users.

User Experiences and Concerns

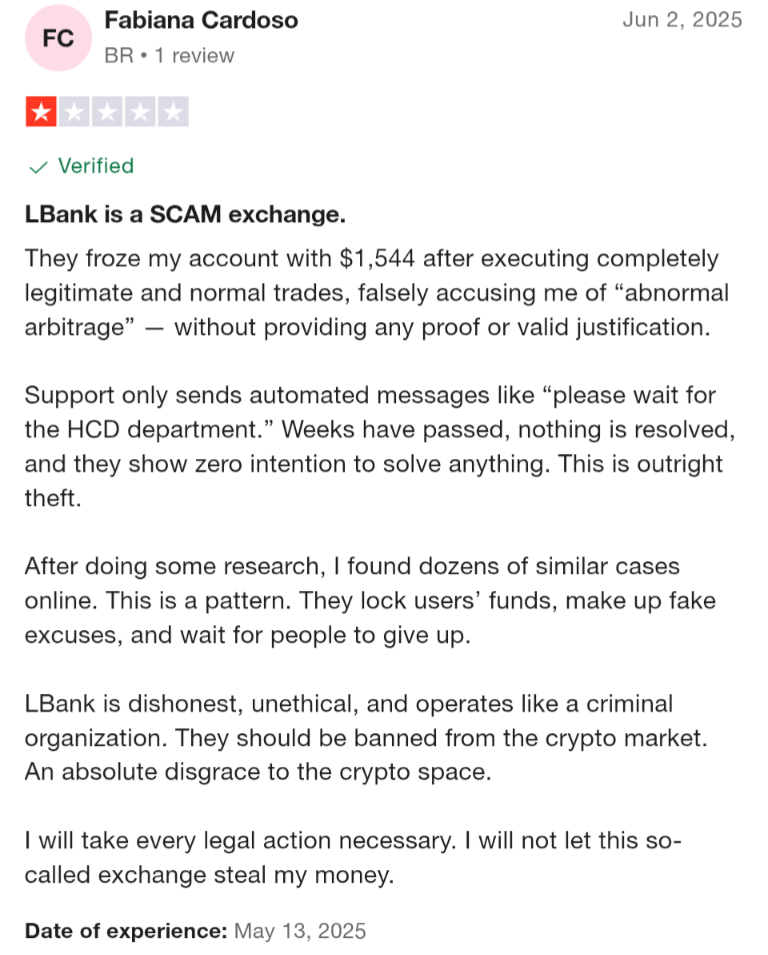

Reports from users highlight significant concerns regarding the platform's practices. Instances of accounts being frozen or blocked during withdrawal attempts, sudden requests for extensive identity verification documents, and unresponsive customer support have been noted. Such experiences raise questions about the platform's commitment to user security and transparency.

See the attachment below of a review given by users on trustpilot.com

Engaging in trading on LBank without asset insurance is akin to gambling with your funds. In an industry still recovering from past exchange hacks and operational failures, relying solely on an exchange’s internal security measures without any external indemnification is a high-stakes gamble. This omission significantly elevates the inherent risk of trading on LBank, making it a less attractive option for investors who prioritize capital preservation and seek a higher degree of financial security for their digital assets.

Conclusion

In the unpredictable and often volatile landscape of cryptocurrency, the security of user assets should be paramount. LBank's lack of asset insurance and the limitations of its Insurance Fund expose users to significant risks. Traders and investors seeking a trustworthy and secure platform should consider exchanges that offer comprehensive asset protection and demonstrate a commitment to user security. Opting for platforms with robust insurance coverage is a prudent step toward safeguarding your digital assets in the ever-evolving crypto market